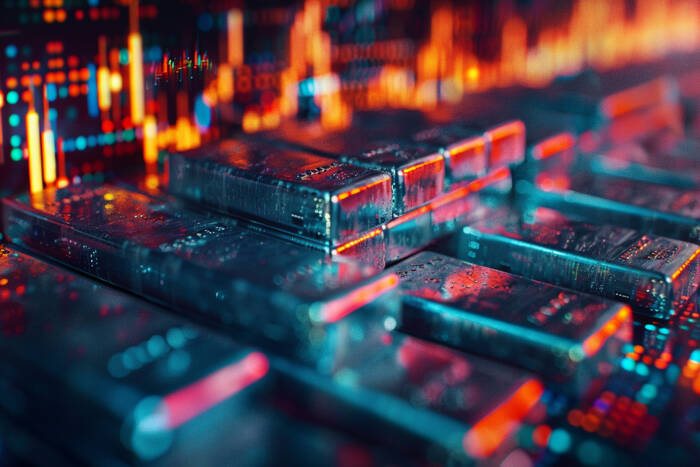

Silver prices have staged a notable recovery sparking optimism for potential bullish momentum. Easing inflation data and shifting Federal Reserve rate expectations for 2024 have also provided a supportive backdrop for silver.

The market now eyes a critical resistance zone at $29.65, with indicators signalling pivotal price movements in the coming days.

Silver price dynamics (May-December 2024). Source: TradingView.

Silver’s most recent seven-day consecutive decline drove the price to $28.75, its lowest level in three months. This dip coincided with the Relative Strength Index (RSI) nearing oversold territory and the 50-day Exponential Moving Average (EMA) cushioning further losses. However, silver prices rebounded sharply, climbing over 3% from this low as the 250-day EMA offered strong technical support.

Easing inflation data bolstered silver’s recovery, with the core Personal Consumption Expenditures (PCE) index (the Federal Reserve’s preferred inflation measure) posting its smallest six-month rise. Market sentiment has shifted towards the possibility of more significant rate cuts in 2024, beyond the Fed’s current projection of two 25 basis point reductions. Additionally, robust US GDP revisions and declining unemployment claims have added to silver’s positive momentum.

Silver price forecast: Key resistance at $29.65 as technical indicators strengthen

As silver challenges the $29.65 resistance zone, RSI is advancing towards the mid-50 level. A successful breakout above this level could pave the way for an uptrend. Conversely, failure to breach $29.65 may lead to a retest of the 250-day EMA. Hence, silver’s price near-term trajectory hinges on its ability to sustain momentum above the $29.65 resistance levels.

Silver prices dropped after better-than-expected U.S. GDP data and lower jobless claims. The attempted rally on December 19 was rejected at $29.65.